tax shelter real estate investment

Overall your business structure will. Historically real estate has proved to be a significant tax shelter.

Tax Strategy Tuesday Avoid Real Estate Net Investment Income Tax Evergreen Small Business

Our Investment Fund practice serves a range of clients in the financial services industry including private equity funds hedge funds fund of funds real estate and capital market clients.

. To shelter real estate investment cash flow from taxes emphasize to investors that they can buy like-kind properties through tax-free exchanges also referred to as a Section. RSM US LLP is looking for a Tax Senior Manager to join our expanding Investment Fund practice. REITs are investment vehicles that were established by Congress in 1960.

2021 Shelter Real Estate Investment Strategies. Individually owned properties can be subject to estate taxes Estate taxes are an important element of your long-term strategy to consider. As an example lets assume that a property has a cash flow of 5000 in other words the cash income from the property.

The result is that rental real estate is a secret tax shelter that few people ever consider. Our Investment Fund practice serves a range of clients in the financial services industry. Some people have called it the modern-day tax shelter as it provides significant benefits under the federal tax code.

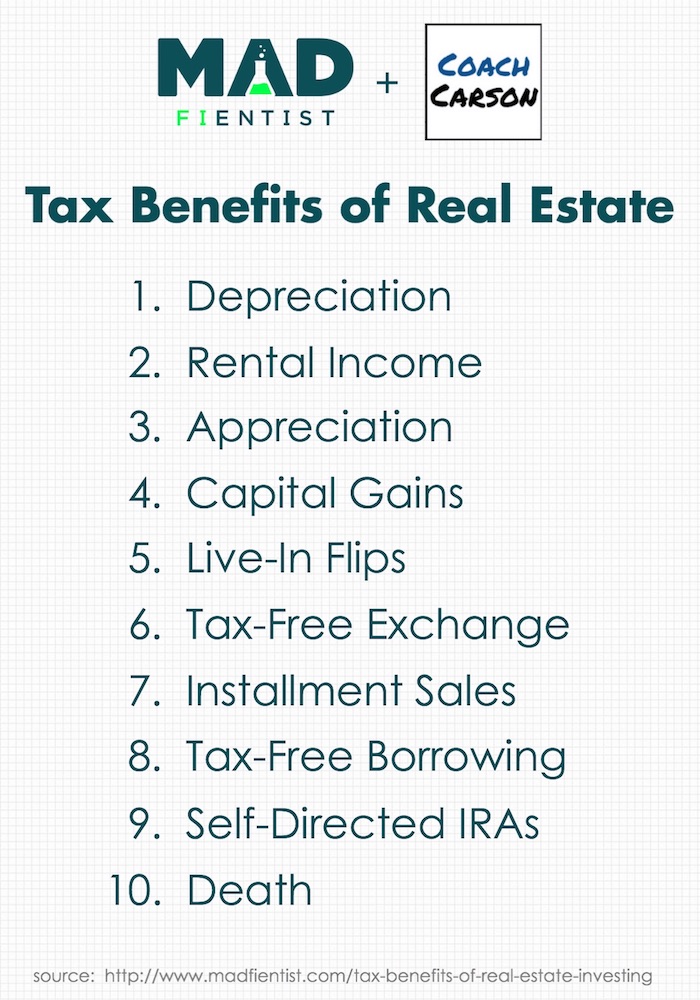

Real estate offers tax sheltering through depreciation operating expenses long-term capital gains and 1031 exchanges. Use Real Estate Tax Write-Offs. IMGCAP 1In every country Ive been in real estate is the best tax shelter said Tom Wheelwright CPA an advisor and speaker at.

A tax shelter is a vehicle used by taxpayers to minimize or decrease their taxable incomes and therefore tax liabilities. And its an investment asset. To see how a real estate tax shelter works lets go.

Story continues below. Our Investment Fund practice serves a range of clients in the financial services industry including private equity funds hedge funds fund of funds real estate and capital market clients. One of the hopes of a well.

A tax shelter is advantageous by the taxpayers in high tax brackets so they can take losses from it to reduce. Tax shelters can range from investments or. EDT 2 Min Read.

Up to 16 cash back Get this The Daily Item page for free from Friday October 20 1989 er NewspspersFrldsy October 20 1969 RDNROPPKOS NR PC MR j -- i y w y -w wt a y i i 1 wv-w 1. Allowable deductions are typically allowed only to the amount at-risk. Since we dont want you go to jail here are three legitimate examples of a tax shelter with regards to real estate investments.

July 16 2015 331 pm. You get to deduct. Tax lien investing is the act of buying the delinquent tax lien on a property and earning profits as the property owner pays interest on the certificate or from the liquidation of the collateral.

One of the biggest financial perks of this income stream is the real estate investment tax deductions youre able to take.

Five I D E A L Benefits Of Real Estate Investing Coach Carson

Tax Benefits Of Rental Property

The Incredible Tax Benefits Of Real Estate Investing

What Is A Tax Shelter The Ascent By Motley Fool

Gimme Shelter Help Clients Leverage Real Estate S Investment Clout And Tax Advantages Quickread News For The Financial Consulting Professionalquickread News For The Financial Consulting Professional

Tax Impacts Of Capitalizing Versus Expensing Costs Of Real Estate

What Are Tax Sheltered Investments Types Risks Benefits

Quiz Worksheet Tax Shelters Passive Activity Loss Study Com

The Unofficial Guide To Real Estate Investing Unofficial Guides Strauss Spencer Stone Martin 9780764537097 Amazon Com Books

9 Legal Tax Shelters To Protect Your Money Gobankingrates

The Tax Free Exchange Loophole How Real Estate Investors Can Profit From The 1031 Exchange Cummings Jack 0723812718344 Amazon Com Books

How To Get Into Real Estate Investing In Your 30s Debt Free Doctor

What Are Tax Shelters Turbotax Tax Tips Videos

Is An Llc Or S Corp Better For Real Estate Investors New Silver

Rental Activity Loss Rules For Real Estate Htj Tax

Investors Recentric Real Estate Commercial Medical Real Estate Acquisitions

How Physicians Can Shelter W 2 Income With Real Estate Professional Status Reps

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Tax Shelters For High W 2 Income Every Doctor Must Read This